By Anton Tagliaferro and Nigel Hale

READ

Telstra’s share price performance has been lacklustre over the last few years, as the loss of the company’s fixed line earnings to the National Broadband Network and a competitive mobile sector have crimped its earnings, with many investors also doubting the company’s ability to maintain its current level of dividends. So what does IML find attractive about Telstra, and why have we increased our holdings over the last three to six months?

Despite the headwinds of the last few years from the loss of fixed line revenues to the NBN and declining mobile earnings, we remain optimistic about Telstra for three key reasons – the prospect of improved mobile earnings as a result of consolidation in the sector; the likely monetisation of some of Telstra’s infrastructure assets; and Telstra’s projected strong cashflows, all of which should enable the company to improve its financial position and maintain its dividend.

Improved Mobile Earnings Ahead

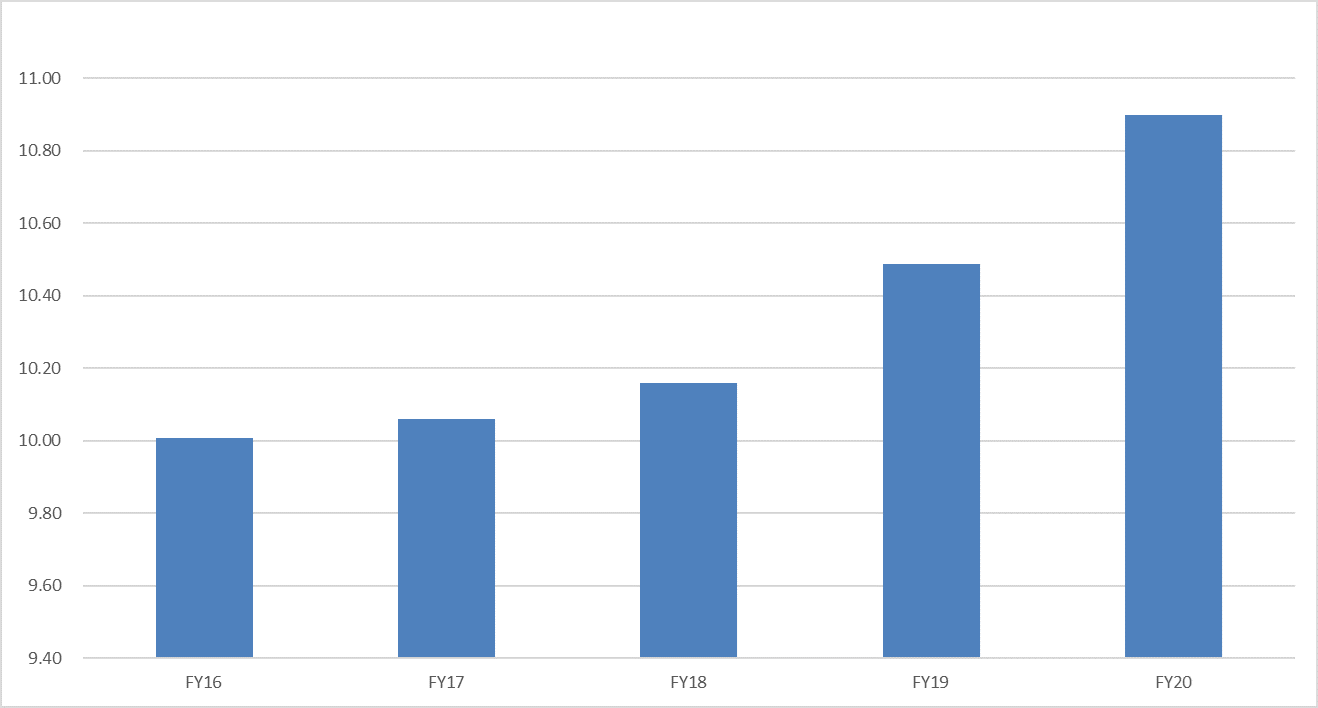

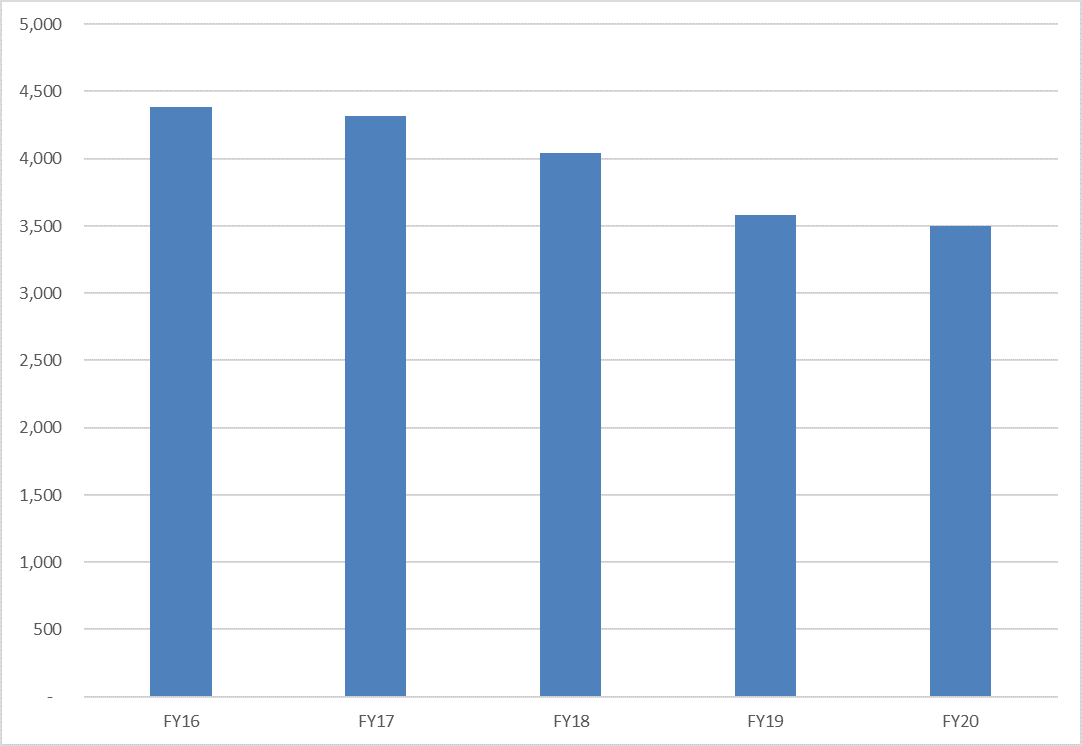

Telstra is the largest mobile operator in Australia with over 50% market share. Despite Telstra’s mobile customer number having grown from 10 million in 2016 to almost 11 million in 2020 (Chart 1 below), over this period the earnings before interest, taxes, depreciation and amortisation (EBITDA) in Telstra’s mobile division have declined by just over 20 % from A$4.4 billion to A$3.5 billion over the same period (Chart 2).

Chart 1: Increase in Telstra Mobile Subscribers (Millions), Financial Years 2016 – 20

Source: IML, based on company disclosures

Chart 2: Decrease in Telstra Mobile Earnings (A$bn), Financial Years 2016 – 20

Source: IML, based on company disclosures

The main reason for this decline in Telstra’s mobile earnings, despite higher customer numbers, is due mainly to a decision made by Optus in 2017 to seek to gain market share by aggressively discounting its prices and adding inclusions such as the English Premier League soccer content. Rather than allow itself to lose market share, Telstra responded swiftly to Optus’ tactics by lowering its prices, simplifying its mobile plans and cutting its costs aggressively to offset some of the loss of earnings. Telstra’s strategy led the company to retain its market share while Optus’ strategy of looking to gain market share in mobile through its aggressive price tactics appear to have failed badly, as Optus underestimated Telstra’s swift reaction.

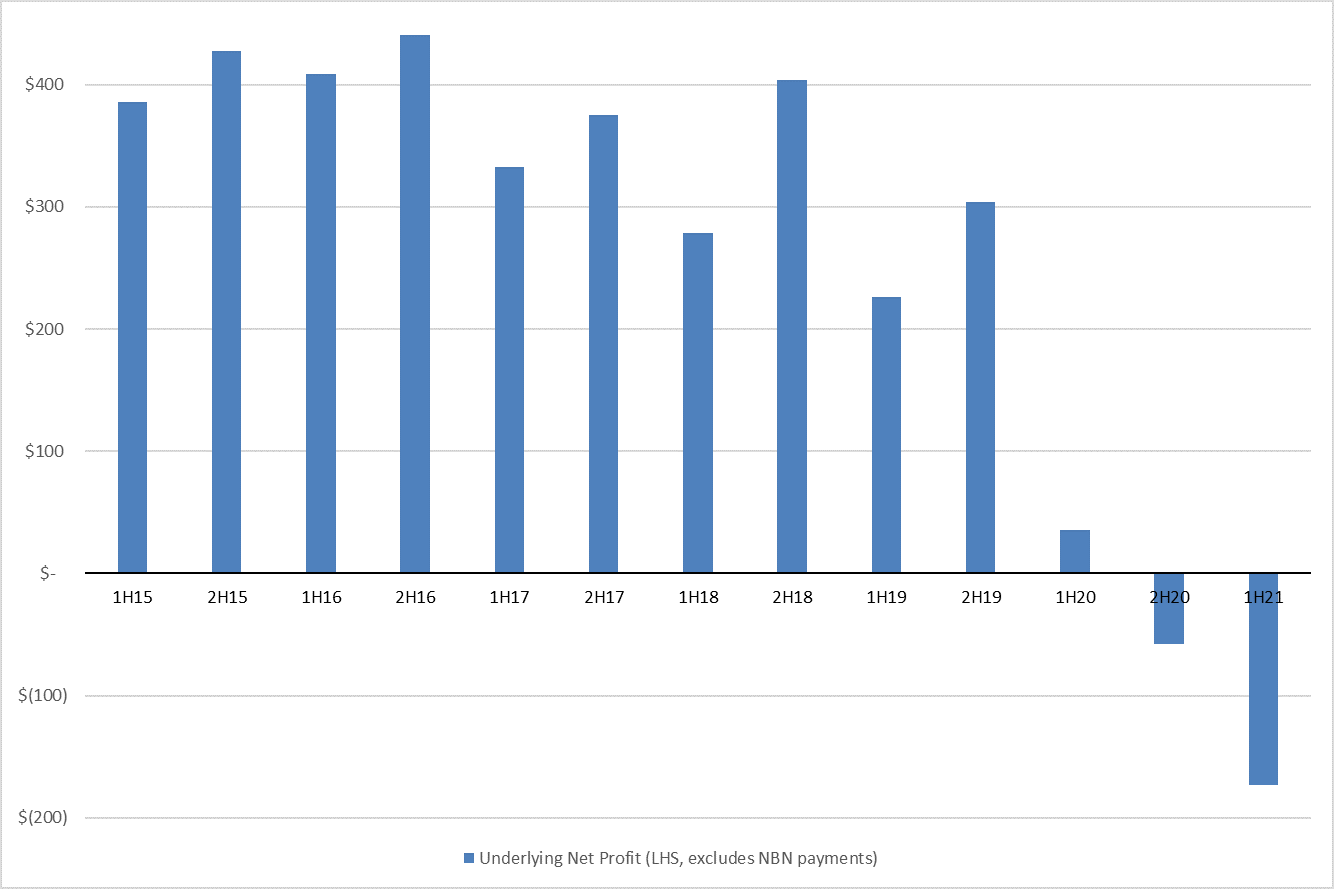

While Optus’ aggressive price tactics have hurt Telstra’s mobile earnings as shown above, the impact on Optus has been fairly disastrous – as Chart 3 below shows. The chart shows that Optus’ underlying net profit after tax (NPAT) has declined from A$350 million per half year to an underlying NPAT loss of almost A$200 million in the last half year’s results. (The underlying earnings figures referenced here excludes one-off NBN disconnection payments.) This has put Optus in an unsustainable loss-making position, particularly given that the company has to also continue to invest heavily in rolling out its 5G network.

Chart 3: Optus Half Yearly Underlying Earnings (A$m), 2015 – 21

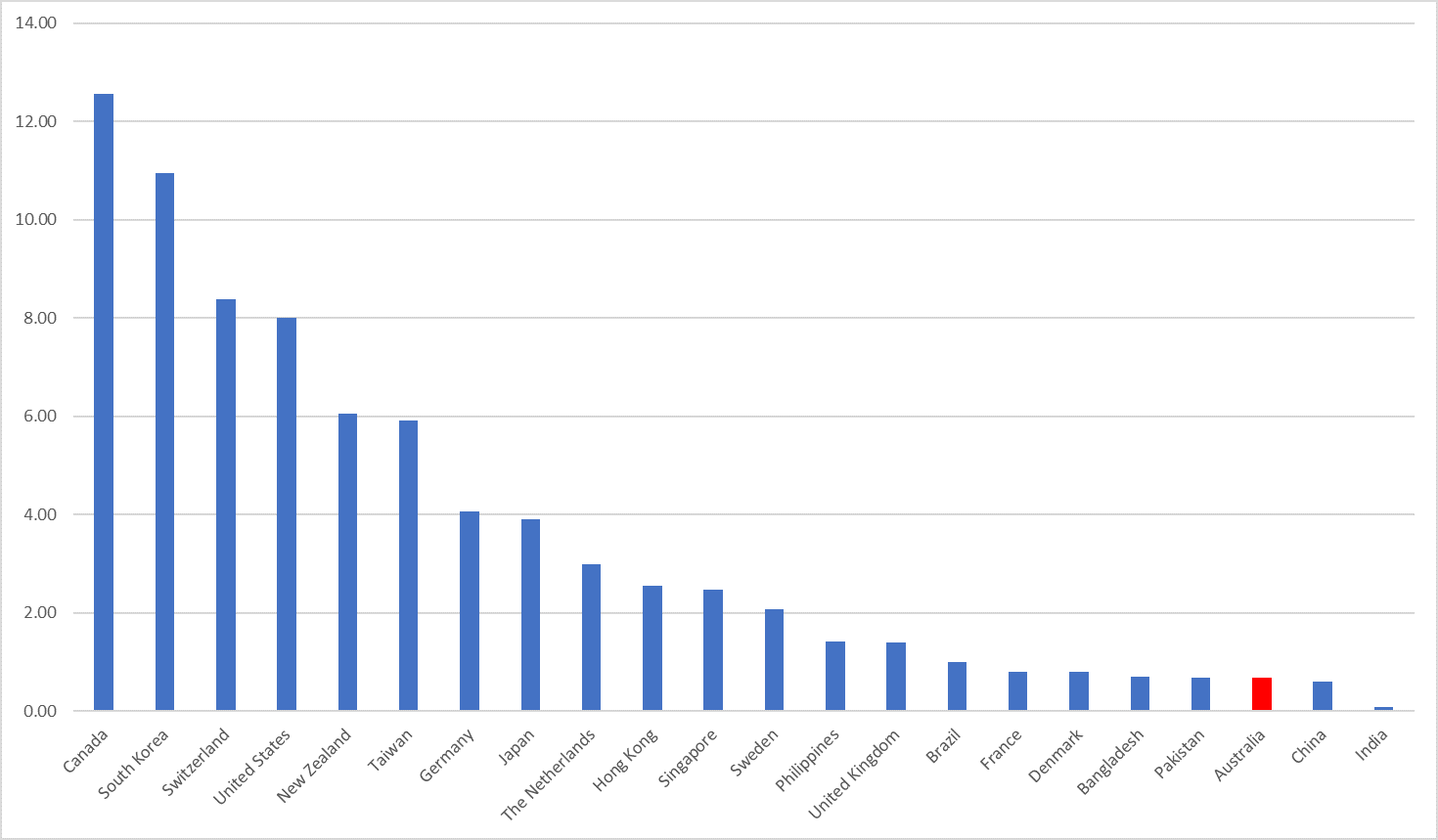

While the price war has substantially affected Telstra and Optus’ earnings, it has also benefitted Australian consumers, as Australia’s prices for mobile data are now among the lowest in the world (Chart 4). However, we believe it is inevitable that the Australian mobile market will become more rational, given Optus’ loss-making status.

Chart 4: Average Price of 1GB Mobile Data ($US)

Source: www.cable.co.uk/mobiles/worldwide-data-pricing/

If one looks at the chart above, Australians are paying less for their mobile data than places like Pakistan and Bangladesh, and we believe that over time, mobile rates in Australia will rise to be more in line with other developed market economies.

Optus’ aggressive pricing strategy has placed the company in an unsustainable situation where it is recording heavy losses, and it can no longer afford to offer discounted prices, fund the rollout of its 5G network or continue to pay dividends to its parent Singtel. Vodafone, the third player in the mobile market, is in a similar if not worse situation than Optus, having recorded a string of very poor results as Vodafone appears to have lost some mobile market share in the last few years.

Another reason to believe that the mobile sector’s earnings declines may be close to turning is that there has been substantial consolidation in the mobile sector during 2020. Optus recently announced that it was buying amaysim’s mobile operations, while TPG abandoned its plans to roll out a new mobile network and instead announced a merger with Vodafone. These transactions all make strategic sense, and appear to be pointing to a more orderly market ahead, as the three major operators will each own a premium and a discount brand (Telstra/Belong, Optus/amaysim, and Vodafone/TPG/Felix).

We believe that a more orderly market will also help in restoring sector profitability for mobile operators in the years ahead, given that all the telecommunications providers – led by Telstra – are rapidly deploying their 5G networks, providing an opportunity to increase prices as the speed and functionality of mobile networks increase under 5G. The mobile companies’ 5G networks will also enable them to compete directly for customers with the NBN in some cases, which is a further positive for the mobile sector.

Monetisation of Telstra’s Infrastructure Assets

We have always believed that most investors have underappreciated and undervalued Telstra’s extensive portfolio of infrastructure assets. We were therefore very encouraged when at its very recent November investor day, Telstra announced that it is well advanced in splitting the company into three separate businesses, named ‘InfraCo Towers’, ‘InfraCo Fixed’, and ‘ServeCo’.

InfraCo Towers will own Telstra’s 5,570 mobile towers, and Telstra has announced that a process will soon commence to sell this business or part of it in 2021. We believe that such a sale will be highly accretive for Telstra shareholders, as comparable companies such as Crown Castle and American Tower in the United States and Cellnex in Europe trade on valuations of around 22 – 25 times EBITDA, compared to Telstra’s overall group valuation of less than 8 times EBITDA. Telstra expects that InfraCo Towers will earn approximately A$200 million per annum in EBITDA, which implies a potential valuation uplift for Telstra in the order of 20 – 30 cents per share.

InfraCo Fixed will own 250,000 kilometres of fibre optic cables, 10,000 exchanges and fixed network sites, 370,000 kilometres of ducts and pipes, and Telstra’s network of subsea cables. Telstra estimates this division’s EBITDA to be around A$1.5 billion per annum, making it many times more valuable than the InfraCo Towers division. While the process of physically selling or separating this asset will take longer than for the towers, the improved disclosure from Telstra will enable investors to better appreciate the underlying value of Telstra’s infrastructure assets.

ServeCo will be the largest of Telstra’s three businesses and will own all of Telstra’s operating businesses. This division will be responsible for all Telstra’s retail stores, customer service and network design and operation of the active components of its network infrastructure. ServeCo will be the market leader in both the fixed line and mobile markets, as well as in enterprise and government services, as Telstra is today.

Strong Cashflow to Support Dividend

While the Rudd Federal Government’s decision to roll out the NBN meant that Telstra lost the majority of its fixed line revenues, it has also meant that Telstra is transforming itself into a much less capital intensive business. This is principally because the NBN is now responsible for maintaining the nationwide fixed line network, with Telstra acting as a reseller of these services.

Telstra is now targeting a capital expenditure to sales ratio of 12% at the group level. This ratio is substantially lower than the mid-teens spending rate of previous years, and means that Telstra’s free cashflow looks set to increase materially in the years ahead. On our forecasts, Telstra should generate free cashflow of over 20 cents per share from FY22 onwards, which should grow, meaning that Telstra should be in a position to maintain – and look to grow – its 16 cents fully franked dividend.

Conclusion

In summary, Telstra has weathered the major headwinds of the NBN rollout and aggressive competition from Optus, and has maintained its market-leading positions in all major market segments. A more rational mobile market, improved operating efficiencies, strong cashflow generation, and opportunities to monetise its strong collection of infrastructure assets all point to why we are optimistic about Telstra’s positioning and its potential to increase its earnings and dividends per share in the years ahead.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Past performance is not a reliable indicator of future performance.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.