By Simon Conn & Marc Whittaker

READ

Calendar year 2022 was a difficult one for investors in the small cap sector of the market – with the ASX Small Ordinaries index falling -20.4% over the year. As interest rates increased rapidly through the year, and fears grew over the outlook for the economy, the small company section of the market dropped significantly (in contrast to the large cap end of the market which was only down -3.9%). However, while small caps in general underperformed, performance was not uniform.

Surprisingly, given the slowing global growth outlook, small resources were more resilient than expected falling -8.4%, while the small industrials sector fell -24.2%. The resources sector was helped by strong performances from EV-related stocks and coal producers.

While the Industrials sector normally performs more consistently, this did not happen in 2022 with a large number of stocks experiencing significant price falls. In some instances, this was in reaction to a negative update, in others it was due to an uncertain outlook for the sector in which they operate, and in several cases there was no obvious reason other than that liquidity had dried up.

Why small cap industrials are well positioned for long-term investors

While this made the last year a very tough one for small cap investors, it does mean valuations for small industrials have factored in a lot of negative news already.

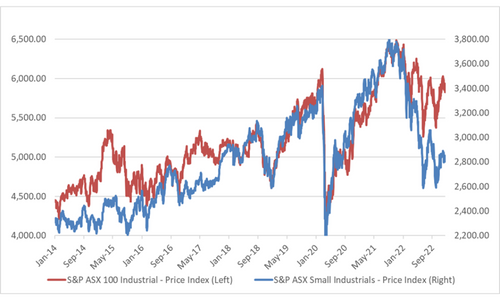

This chart shows Australian small cap industrials vs large cap industrials over the past 10 years.

Source: Factset as at 30 November, 2022

The chart shows that small industrials and large industrials have tracked each other quite closely for much of the past 10 years. However, over the past year a significant value gap has opened between the two indexes.

Small industrials are trading at their biggest discount for over a decade

The drop in small cap industrials over the past year means we are seeing significant opportunity to own high-quality small and mid-cap companies on low earnings multiples with attractive dividend yields. These are companies that have genuine competitive advantage, good management teams, and the resilience to manage the current uncertainty – all qualities which are particularly important in a slowing economy.

Here are three companies that we think have the qualities necessary to succeed in this uncertain environment. They are high quality companies, with good growth prospects, trading at very attractive valuations.

Bega (BGA)

Bega has diversified away from its commodity-producing roots over the last few years. It has built a portfolio of consumer brands spanning the dairy and spreads categories, culminating with its acquisition of Lion Dairy and Drinks (LDD) in January 2021. However, since this acquisition investors have not had the opportunity to witness the true earnings potential of the combined group which now owns some of Australia’s most iconic brands, including Vegemite, Pura, Dairy Farmers and Farmers Union.

It had a very challenging FY 2022 as a series of one-off events: from Covid, to Shanghai-shutdowns negatively impacted its June 2022 result by over $40m. Then as operations were returning to normal Bega witnessed a rapid increase in costs, particularly the price it pays farmers for milk (the rate is set every year on 30 June for the following 12 months) which impacted the earnings outlook for FY2023 and meant it needed to pass on significantly increased costs to its customers. However, at its recent AGM Bega confirmed that it had finished implementing these price increases and its profit for the 2nd half of FY2023 should be back to the level it anticipated when it bought LDD.

If we look ahead to FY 24, when Bega’s margins should normalise, that would have it trading at around 16 times normalised cash profit.

In summary, the reasons we are attracted to Bega as an investment are:

- Competitive advantage. Its stable of well-known brands as well as its infrastructure, integrated supply chain, and its diversified earnings (it sells into the “route trade” – petrol stations, convenience stores etc as well as the supermarket sector) give it a competitive advantage. This gives it a greater ability to pass on higher costs to its customers, as evidenced its recent price increases.

- Balance sheet. Bega has a significant asset base on its balance sheet, including land & buildings worth c$400m. One site has already been identified by management as being surplus to requirements and, if sold, could free up capital to pay down debt or for capital management.

- Management. Bega has been astutely led by the current Chairman for a significant time who has overseen the company grow from a small dairy company with one operating site on the South Coast of NSW to today being one of Australia’s leading food and dairy companies.

GUD Holdings (ASX:GUD)

GUD has made a series of acquisitions over recent years in order to diversify its earnings. This makes it more resilient, while providing a potential growth driver for earnings.

Historically GUD’s focus was the ANZ automotive aftermarket, through brands such as Ryco filters and DBA brakes. This division is relatively defensive given the wear and tear nature of demand for its products, and generates significant cash, however it has limited growth potential.

In late CY2021 GUD acquired Auto Pacific Group, which owns a range of SUV towbar, trailering and functional accessories. This was the most significant of several acquisitions targeted at building a portfolio of well-established brands in the SUV accessories market. In the months following this acquisition, Covid-related supply chain disruptions led GUD to miss its earnings targets, despite a record level of SUV customer orders in the Australian market.

We see this setback as temporary, with GUD well placed for the future with a much more diverse business than in the past. We are attracted to GUD because of its:

- Good growth prospects. The Covid supply chain issues are slowly abating: December 2022 new car imports were up 12% on December 2021. This should see a return to growth for GUD’s accessories business over time as these vehicles are delivered into the market.

- Pricing power. GUD has had good success in the past in raising prices to mitigate cost increases, given its portfolio of well-recognised brands in the aftermarket and focus on wear and tear parts for the trade, where range and service are valued.

- Attractive valuation. At current levels, GUD is very attractively priced at under 10 times FY2023 earnings with earnings that should grow into FY2024 as supply chains normalise and recently won contracts with major Australian car companies are fulfilled.

Australian Clinical Labs (ASX:ACL)

ACL is relatively new on the ASX, listing in May 2021. However, as a pathology operator, the earnings history of the other listed pathology operators indicate that this sector of the market is attractive for investors. Blood testing volumes tend to grow c5% pa over time driven by an ageing population and the ability to test more diseases via blood samples. This underpins a recurring and growing income stream as cost growth tends to be less than 5% as more tests can be run through the same fixed-cost lab network.

Its earnings grew strongly through the pandemic as it processed very large numbers of Covid tests. While this demand has abated, its business-as-usual volumes have increased as the backlog of medical procedures put off during Covid continues to work through the medical system. The reduction in Covid testing volumes has seen the share price fall as investors try to assess the level of underlying earnings.

ACL used the cash generated from Covid to pay down debt, pay 63c in fully franked dividends for the financial year 2022 (well above the dividend forecast at the time of listing of c10c) and acquire Medlab – all in its first full financial year as a listed company.

We are attracted to ACL as it has many of the attributes we look for in a company. It is trading at an attractive valuation of less than 14 x FY24 earnings [based on business as usual (BAU) volumes] and a yield over 4% with a strong balance sheet. It also has:

- Competitive advantage. ACL has invested significantly in its national laboratory footprint, which allows it to flex its costs up and down as volumes fluctuate. This unified national laboratory system enables it to process samples in any laboratory around the country, so maximising the efficiency of its fixed-cost, laboratory network.

- Growing earnings. At its latest AGM, ACL stated that BAU volumes are returning to normal and are growing faster than the market so far this financial year. The recent acquisition of Medlab is a significant development for the company as this provides ACL with a presence in the Queensland market for the first time, meaning it is now able to offer a national footprint to customers and tender for national contracts. It is one of only three national pathology providers.

- Capable management team. We believe the management team at ACL are highly capable. They have a long history in the industry and have demonstrated since IPO, through a very volatile period, an ability to meet volume demands in a timely manner while keeping costs in check.

While 2022 was a challenging year for small cap investors, particularly in the industrial space, this means the starting point for 2023 is much lower. When expectations are low and seemingly one-off events have affected the earnings of a company this usually presents an opportunity for a patientinvestor like IML. While inflation will remain a factor in the future, we believe that well-established small cap companies with a competitive advantage, recurring earnings and capable management should be the focus for investors in this increasingly uncertain world.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (IML) (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. IML is the responsible entity for the IML Funds. Product Disclosure Statements (PDS) and Target Market Determinations are available on www.iml.com.au. Potential investors should read the relevant PDS and TMD before deciding whether to invest, or continue to invest, in the Funds. Past performance is not a reliable indicator of future performance. Any forecasts referred to in this article constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.